57+ can you write off mortgage interest on a rental property

Web Note that if any portion of the loan proceeds are used for something other than the rental property the portion of interest allocable to loan proceeds not related to. You should have entered the.

2384b Flowery Trail Rd Chewelah Wa 99109 Realtor Com

Ask Online Right Now.

. Web Property taxes and PMI are both deductible expenses from your rental property income. For example if you. Web Key Takeaways.

Features At tax season your lender will send you Form 1098 which documents your. Web There is a catch. Instead these expenses are added to your basis in the.

Mortgage interest For example. Only the mortgage interest can be entered as an expenses for the rental property not the principal. The loan must be secured by principal residences aka a main home or second home that you use through a deed of trust mortgage or land.

Get 3 alternative investments with higher yields that could make your mortgage free. Dont Take Chances w the Law. Web June 4 2019 1135 PM.

Choose the Type of Property Provide Your Details with Our Step-by-Step Instructions. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property.

Get an Expert Opinion2nd Opinion. Ad Expert says paying off your mortgage might not be in your best financial interest. Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income.

Most residential rental property is depreciated. Ad Get a High-Quality Fill-in-the-Blank Satisfaction of Mortgage. This can save you a lot of money on your tax bill.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Get Streamlined Access and Unlimited Legal Questions. Web Yes if you receive rental income from a property you are entitled to deduct certain expenses including mortgage interest property tax operating expenses.

Homeowners who bought houses before. Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property. Rental property owners can deduct the costs of owning maintaining and operating the property.

Web While you only can write off mortgage interest and property taxes on your personal residence the IRS treats investment property much more generously. Web If you meet all of the requirements you can write off the money that you paid in property taxes. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Can You Deduct Mortgage Interest On A Rental Property

57 Property In Goa Apartments Flats Houses Offices For Sale In Assonora Goa Justdial Real Estate

Property In Marathahalli Bangalore 309 Real Estate Property For Sale In Marathahalli Bangalore

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

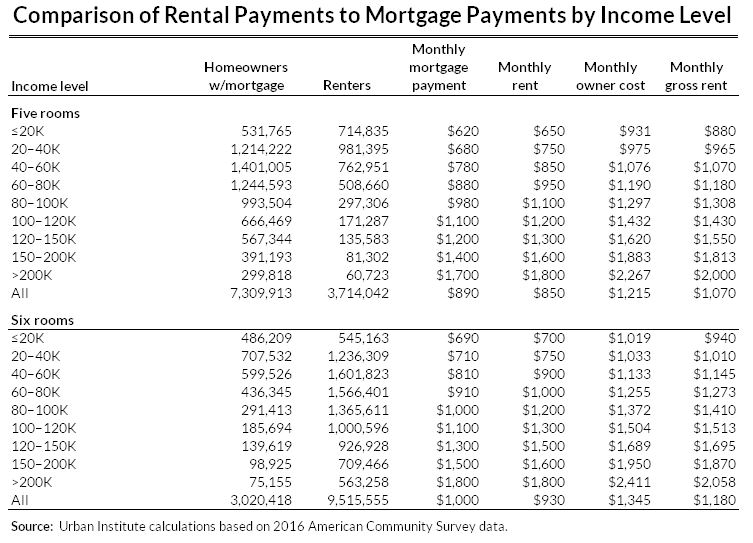

Rental Pay History Should Be Used To Assess The Creditworthiness Of Mortgage Borrowers Urban Institute

Flats For Rent In Baguiati Kolkata Without Brokerage 94 Owner Flats In Baguiati Kolkata

57 Catchy Mortgage Slogans Taglines Slogans Hub

Juj6jru5dzvq4m

How Much Do I Need In My Pension To Retire At 55

33 Pepper Hill Road Holmes Ny 12531 Mls H6233723 Zillow

1151 Us Highway 1 Littleton Me 04730 Realtor Com

What Is The Mortgage Interest Deduction And How Does It Work Thestreet

2 Bhk Flats For Rent In Baguiati Kolkata 57 2 Bhk Rental Flats In Baguiati Kolkata

57 Business Ideas In Surat For 2023 Untapped Business Ideas

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Beekman Homes For Sale Beekman Ny Real Estate Redfin

Farm What To Write Off On Your Rental Property